Howden: Cyber insurance could ‘rival major P&C lines’

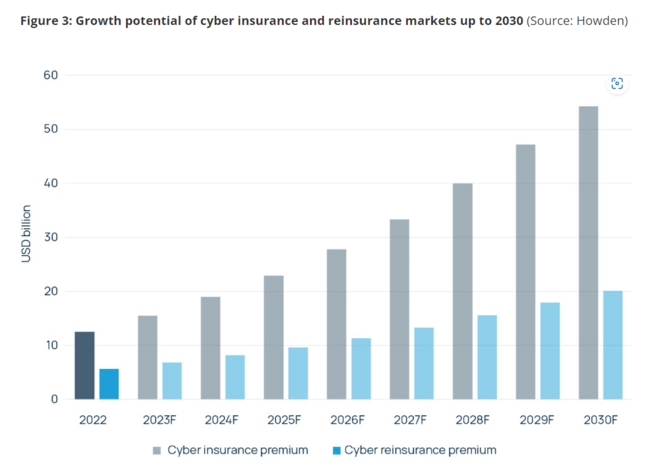

In its third cyber report, ‘Coming of Age’, insurance broker Howden says the scale of cyber insurance could rival major P&C lines in the future if key challenges are met: penetrating new markets (particularly SMEs), addressing systemic risk, and expanding available capital.

Should this happen, Howden believes the cyber insurance market could reach US$50bn by 2030.

Getting ahead of cyber-warfare

The broker adds that, by highlighting key challenges associated with scaling cyber insurance coverage, it can be at the forefront of proactively providing clarity to clients and investors around the scope of cover amid a volatile geopolitical landscape.

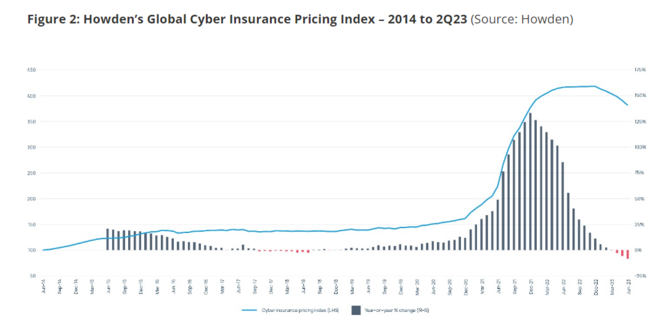

And, according to Howden, now may be a good time to take out cyber insurance, with price increases that have driven the growth of cyber insurance since 2021 now receding.

What’s more, despite initial contentions around providing coverage for cyber warfare, clients are recognising the importance of proactively scoping out the parameters of cover. Cyber insurance may minimise the potential for coverage disputes for customers while providing underwriters and investors confidence to commit to this growing market.

Sarah Neild, Head of UK Cyber Retail at Howden, says: “Getting this right is crucial for the sustainability of the cyber market. By providing a framework designed specifically for cyber’s unique risk profile, clients will be offered more certainty around the parameters of cover and what is insurable and what is not.

“The process of defining the limits of cover specific to cyber acts of war will help to fulfill the potential of this market, but only if the clauses are fit for purpose and clients’ needs are met.”

Penetrating new markets

While cyber insurance has picked up in developed markets amid the threat of cyber warfare, those who commit cyber attacks may be shifting focus to emerging markets, where the cost of acquiring coverage would have been prohibitive.

However, with high price tailwinds now unwinding, Howden feels now is the right time for cyber insurers to expand into emerging jurisdictions.

Dan Leahy, Associate Director at Howden, says: “Having navigated the early phases of development that often come with new, fast-growing lines of business, the cost of cyber insurance is now more commensurate with loss costs following the recent correction. While the first half of 2023 has seen a pricing decline, the sustainability of this trend remains uncertain given the pervasive threat environment.

“Rates nevertheless cannot be relied upon to drive market expansion to the extent that they have recently, requiring ambitious plans for exposure growth. Penetrating new territories and company demographics is therefore pivotal to realising the full potential of cyber insurance.”

Raising reinsurance capital

Per Howden’s report, approximately 45% of cyber premiums are currently ceded to reinsurers. Cyber insurance’s direct use of reinsurers is the biggest differentiator between cyber and any other class of business.

Howden’s report adds that “if the cyber market is to scale up to rival other major lines of business, cyber reinsurance supply will need to increase significantly in order to meet demand between now and 2030.

“Whilst cyber reinsurance premiums are currently in the range of US$6bn, they would need to increase more than three times over in order to fulfill growth expectations by the end of the decade.”

As such, the cyber insurance market perhaps needs greater innovation around matching risk to capital, a growing consensus for defining risk, and product innovation around systemic exposures.

Howden’s Global Head of Cyber, Shay Simkin, concludes: “Ensuring that cyber insurance is relevant to clients of all sizes is paramount to improving access in new territories and across different sections of the economy. Attracting capital is also crucial to this goal, a task that should not be underestimated given current macroeconomic challenges and capital constraints.

“Howden remains committed to advocating for clients as the market adapts to what is a fluid and highly charged threat environment. As one of the biggest global insurance intermediaries in the world, we are conscious of our responsibility to inform the discussion in the interests of clients.

“Our report attempts to do just that. The analysis included extends to other critical areas such as supply chain risk, the fallout from the Ukraine war, and read-across implications for future conflicts. By bringing important market trends to the fore, Howden is leading the discussion, enabling us to facilitate the most innovative client solutions and secure unrivalled access to capital providers.”